vermont sales tax on alcohol

Round the tax to a whole cent. 0183 per gallon.

![]()

Wine Beer Liquor Spirits Ralphs

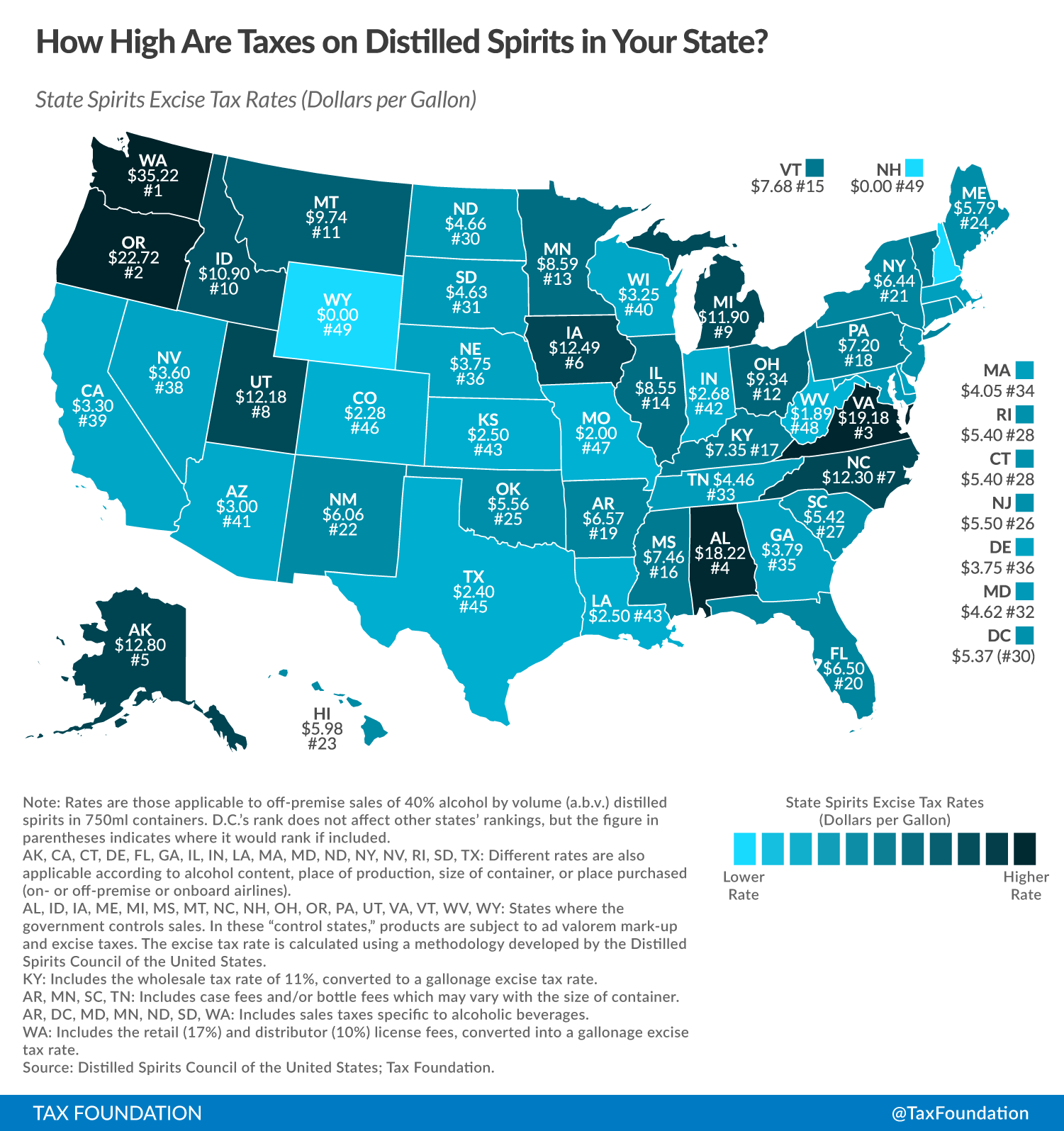

Vermonts excise tax on Spirits is ranked 15 out of the 50 states.

. Are served for immediate consumption are subject to. The first is an alcohol sales tax of 10 plus a 1 local option tax in some cities. Use taxes most often apply to items purchased out-of-state for use in-state.

If the third decimal is greater than four round up. Constitution repealed the Volstead Act Prohibition. Effective June 1 1989.

Alcoholic Beverage Sales Tax. Federal excise tax rates on various motor fuel products are as follows. The state earns revenue by selling alcoholic beverages so there is no need to apply an additional excise tax on.

Contain one-half of 1 or more of alcohol by volume are subject to the 6 Vermont Sales and Use Tax. Vermont has a higher state sales tax than 654 of states. Vermont Use Tax is imposed on the buyer at the same rate as the sales tax.

Vermont has a statewide sales tax rate of 6 which has been in place since 1969. Vermonts sin taxes cover alcohol and cigarettes. Vermonts general sales tax of 6 does not apply to the purchase of liquor.

The tax rate is 6. Beer containing more than 6 alcohol is taxed at. When New Hampshire a state with no sales tax is your neighbor a use tax helps Vermont keep up its tax revenue.

All hard liquor stores in Vermont are state-owned so excise taxes for hard alcohol sales are set by the Distilled Spirits Council of the United States DISCUS. Sales and Use Tax 32 VSA. Liquor sales are only permitted in state alcohol stores also called ABC Stores.

421 Tax is due on beer and wine sold to retailers by wholesale dealers. 974113 with the exception of soft drinks. The state sales tax rate in Vermont is 6000.

What is the alcohol tax in Vermont. Vermont Liquor Tax 15th highest liquor tax. With local taxes the total sales tax rate is between 6000 and 7000.

Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax. Liquefied Natural Gas LNG 0243 per gallon. The Vermont Division of Liquor Control DLC was created in 1933 when the 21st Amendment to the US.

Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0156 for a total of 6156 when combined with the state sales tax. The second is an excise tax which us 27 cents per gallon of beer and 55 cents per gallon of wine. Vermont 802Spirits Current Complete Price List June 2022 Code Brand Size VT Reg Price NH Price VT Sale Price Save Proof Price per OZ 048852 Naud VSOP Cognac 750ML 5999 80 237 049000 Pierre Ferrand 1840 Gr Ch 750ML 4499 90 177 049186 Remy Martin VSOP Cognac 750ML 4799 4499 80 189 049255 Revanche Cognac 750ML 3999 80 158.

If not round down to the nearest cent. W-4VT Employees Withholding Allowance Certificate. For beverages sold by holders of 1st or 3rd class liquor licenses.

Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. Beer and wine which are not part of the control system face two types of taxes in Vermont. 0265gallon Beer above 6 abv.

Vermont is an Alcoholic beverage control state in which the sale of liquor and spirits are state-controlled. Select the Vermont city from the list of popular cities below to see its current sales tax rate. The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states.

11 Vermont Alcoholic Beverage Tax Schedule 10 State Tax 1 Local Option Tax For use where Local Option Alcoholic Beverage Taxapplies EFECTIVE JULY 1 2003 001 - 013 014 - 023 024 - 032 033 - 041 042 - 050 051 - 059 060 - 068 069 - 077 078 - 086 087 - 095 096 - 104 105 - 114 115 - 123 124 - 132 133 - 141 142 - 150 151 - 159. All hard liquor stores in Vermont are state-owned so excise taxes for hard alcohol sales are set by the Distilled Spirits Council of the United States DISCUS. The maximum local tax rate allowed by Vermont law is 1.

IN-111 Vermont Income Tax Return. PA-1 Special Power of Attorney. Vermont Alcoholic Beverage Sales Tax 87238 KB File Format.

For example if the tax you owe is 24443544 the tax is 2444355. Control of the sale and distribution of alcohol was then transferred to state governments. Vermont has recent rate changes Fri Jan 01 2021.

2018 No significant enactments 2017 Delaware. When making tax computations carry the decimal to the third place. Computing Vermonts retail sales tax of 6 percent.

Restaurants are charged at a 9 sales tax rate plus a 1 local sales tax in certain cities and all alcoholic beverages have a 10 sales tax rate plus. Summary of Vermont Alcoholic Beverage Taxes Beer and Wine Gallonage Tax 7 VSA. The tax on alcohol depends on the type and alcohol content of the beverage.

In response all states instituted some form of three-tier system of producers wholesale. O Manufacturers pay the tax on products that they sell directly to consumers Beer up to 6 abv. The sales and use tax is also imposed on many of the items purchased and used by businesses although some items are exempt from tax.

Chapter 233 The sales and use tax is imposed on alcoholic beverages sold at retail that are not for immediate consumption. See definition at 32 VSA. Vermont has a statewide sales tax rate of 6 which has been in place since 1969.

10 Vermont Alcoholic Beverage Tax Schedule For Beverages sold by Holders of 1st or 3rd Class Liquor Licences EFECTIVE JUNE 1 1989 001 - 014 015 - 024 025 - 034 035 - 044 045 - 054 055 - 064 065 - 074 075 - 084 085 - 094 095 - 104 105 - 114 115 - 124 125 - 134 135 - 144 145 - 154 155 - 164 165 - 174 175 - 184 185 - 194 195 - 204.

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Scott Pulls Russian Alcohol From Vermont Shelves Vtdigger

Alcohol Taxes On Beer Wine Spirits Federal State

Google Image Result For Http Shop Schaefers Com Prodimg 21739 Jpg Tequila Distilled Beverage Alcohol Packaging

Falegnameria Artigiana Projects To Try Projects Screwdriver

How Does Selling Alcohol On Doordash Work

Vermont Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

States That Allow Alcohol Delivery What You Need To Know

Vermont Legislature Expands Market For Ready To Drink Spirits Beverages Food Drink Features Seven Days Vermont S Independent Voice

How To Sell Alcohol Online Delivery Laws In All 50 States 2ndkitchen

10 States Have Banned Russian Vodka A Symbolic Gesture With Little Economic Punch

These States Have The Highest And Lowest Alcohol Taxes

Bottle Racket Illinois High Alcohol Taxes Blow Up Cost Of Independence Day Celebrations

By The Numbers North Carolina Ranks 6th Highest On Alcohol Taxes North Carolina Thecentersquare Com